How Supply Chain Disruptions Affect the Economy

Supply chain disruptions have become a major talking point in recent years, significantly impacting various industries and the economy as a whole. From manufacturing delays to logistical challenges, these disruptions ripple across global markets. In this blog, we’ll explore how supply chain disruptions affect the economy and their direct impact on stocks, with a closer look at specific industries such as power and energy.

What Are Supply Chain Disruptions?

Supply chain disruptions refer to interruptions in the regular flow of goods and services from suppliers to consumers. These can be caused by various factors, including:

- Natural disasters like hurricanes or floods

- Pandemics, as seen with COVID-19

- Political unrest or trade wars

- Labor shortages or strikes

- Transportation delays due to logistical bottlenecks

When the supply chain is disrupted, industries struggle to get the materials and products they need, which leads to delays, increased costs, and overall inefficiency.

Economic Impact of Supply Chain Disruptions

Supply chain disruptions can have significant economic implications. Here’s how they affect the economy on multiple levels:

1. Increased Costs for Businesses

Businesses rely on steady and predictable supply chains. Disruptions force companies to either find alternative suppliers at higher costs or face delays. This can result in:

- Higher production costs: Companies may pay more for raw materials and transport.

- Rising prices for consumers: Higher costs are often passed on to consumers, leading to inflation.

- Supply shortages: When businesses can’t meet demand, there may be stockouts and price increases.

2. Impact on Global Trade

When key manufacturing hubs or logistics networks are disrupted, global trade takes a hit. This can lead to:

- Reduced exports and imports: Countries dependent on global supply chains experience delays.

- Slower economic growth: Disruptions in trade reduce the efficiency of global markets and slow down economic progress.

FOR INFORMATIVE CONTENT VISIT.. : Christmas gifts

3. Stock Market Volatility

Supply chain disruptions can create uncertainty in the stock market. Investors tend to react negatively when businesses report issues related to delayed deliveries or production cuts. This can lead to:

- Stock price fluctuations: Industries like manufacturing, retail, and energy are highly dependent on global supply chains. When disruptions occur, their stock prices can fall.

- Sector-specific impacts: Companies in certain sectors like energy can face prolonged disruptions, leading to stock volatility. For instance, energy companies that rely on imported fuel or materials may experience delayed production, impacting their stocks.

4. Employment and Wages

A disrupted supply chain can affect employment and wage structures across industries. For instance:

- Layoffs and reduced working hours: Companies facing production halts may reduce their workforce.

- Increased wages for critical roles: With labor shortages, wages in high-demand industries (such as trucking and logistics) tend to rise.

How Supply Chain Disruptions Impact Stocks

The stock market is highly sensitive to economic changes, and supply chain disruptions can lead to significant fluctuations, especially in sectors dependent on global supply chains. Let’s explore some of the industries most impacted by supply chain disruptions and their corresponding stock market reactions.

1. Energy Sector

The energy sector is one of the most vulnerable to supply chain disruptions, particularly in industries that rely heavily on imported materials, such as power generation. For instance, disruptions in coal or fuel supply can slow down production and create a domino effect in the energy market.

Energy companies, such as Adani Power, are exposed to risks associated with fuel supply disruptions. When delays or shortages occur, they can affect stock prices. Monitoring adani power share price during times of supply chain stress offers insights into how these disruptions directly affect company valuation and stock performance.

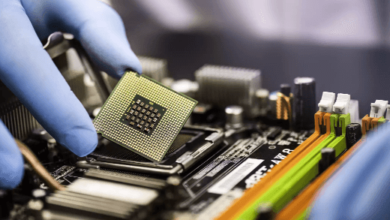

2. Manufacturing and Technology

Manufacturing industries rely on a constant supply of raw materials and components. A disruption in any part of the supply chain, such as semiconductor shortages, can cause delays in production, leading to reduced profits and negatively impacting stock prices.

Companies like automobile manufacturers and tech giants that rely on just-in-time inventory systems may see stock prices dip when supply chains are interrupted.

The Broader Economic Consequences

1. Inflation

Supply chain disruptions can drive inflation by increasing the cost of goods and services. When raw materials or finished products are delayed or in short supply, prices rise, leading to inflationary pressure in the economy.

2. Slowed Economic Growth

Economies dependent on exports and imports are particularly vulnerable to supply chain shocks. When the smooth flow of goods is hindered, economic growth slows down, which may impact key industries such as construction, retail, and energy.

3. Shift Toward Domestic Production

One potential outcome of ongoing supply chain disruptions is a renewed focus on domestic manufacturing. Countries may invest more in localized supply chains to reduce dependence on global networks, which could lead to new economic policies and investments in infrastructure.

Conclusion

Supply chain disruptions have far-reaching consequences for both businesses and the economy. From higher costs to stock market volatility, the impact is felt across various sectors, including manufacturing, energy, and retail. Keeping a close eye on stocks affected by these disruptions, such as Adani Power, can provide valuable insights into market trends and economic health.

As supply chains evolve in response to global challenges, companies and investors must remain vigilant, adapting to the changing landscape to mitigate risks and capitalize on new opportunities.